Self Employed Deserve Benefits Too.

The first ever comprehensive benefits specifically for the self-employed, gig worker, and independent professional.

Your Benefits Matter

Going all in on yourself doesn't need to mean by yourself. We are committed to getting you the benefits you deserve so you can focus on those you serve.Get protected. Be empowered. Grow your business.

Your Personal HR Team

We're the first and only PEO specifically designed to serve self-employed individual business owners. We're here to manage your employee benefits, payroll, workers' compensation, and 401k, so you can focus on what you love - your business.

Dedicated Support

We don't just provide services - we form partnerships. Our experienced professionals are here to answer your questions, guide you through our services, and ensure you get the most out of your partnership with us. We're not just behind-the-scenes administrators; we're an extension of your team. With Gig Worker Solutions, you're never alone on your entrepreneurial journey.

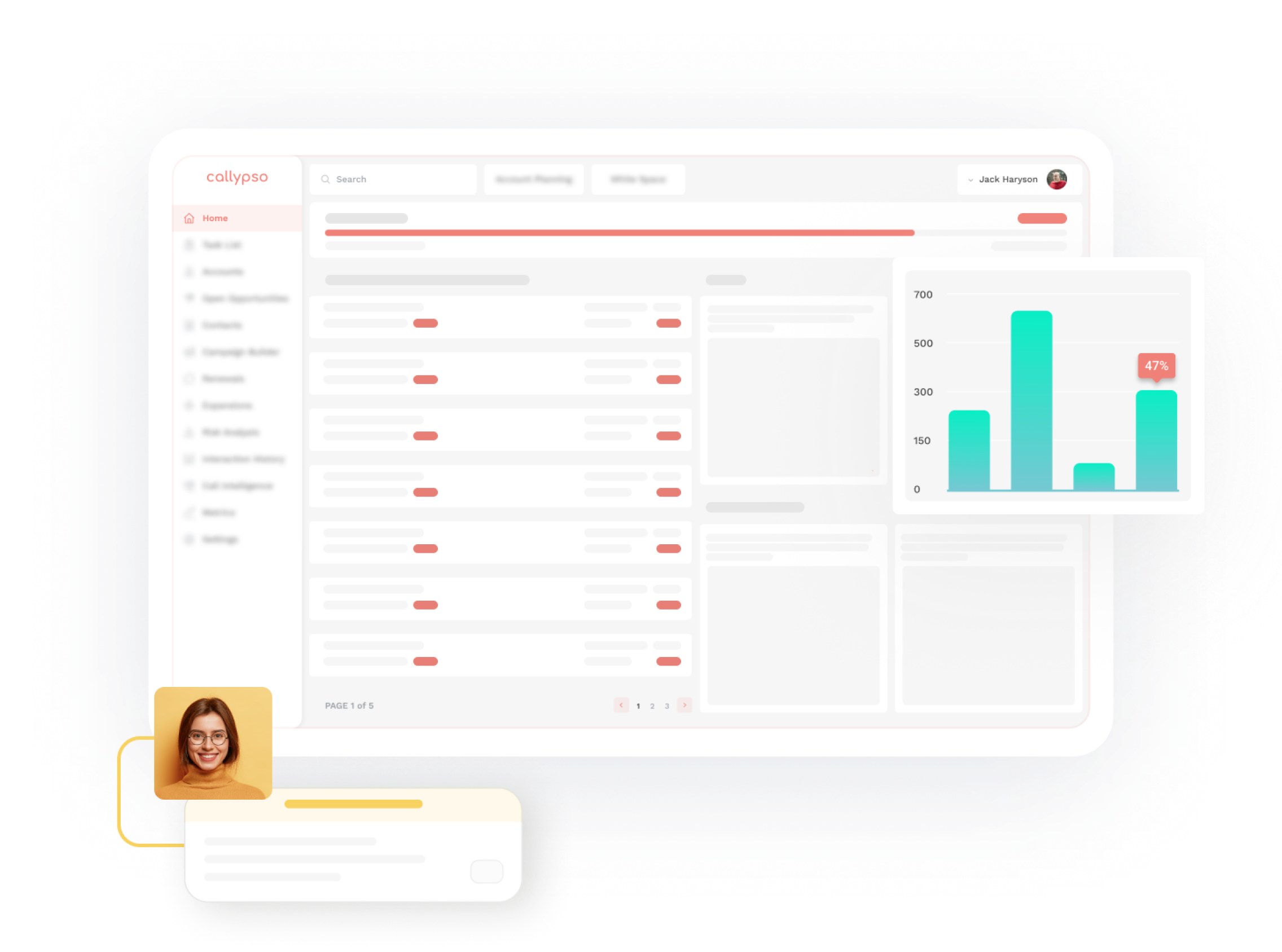

Manage Anytime Anywhere

With our unique benefits software, you can enroll and manage every aspect of your benefits in one secure platform.

- Self manage your benefits

- Enroll at your pace

- Dedicated benefit support

Who We Serve

Our services are specially designed for self-employed individuals operating as S-corporations who earn over $36,000 annually. We're dedicated to helping these entrepreneurs streamline their administrative tasks, allowing them to focus on their passion - running their successful businesses.

How It Works

Create Account

Sign up quickly and easily with Gig Worker Solutions. This is your first step towards streamlining your business administration.

Apply Online

Complete our online application process. It's designed to be user-friendly, secure, and efficient.

Process Payroll

We'll get your payroll up and running within days. Our team ensures it's done accurately and on time, every time.

Elect Your Benefits

Choose the benefits that best meet your needs. We offer a range of options to support your wellbeing and your business.

faq

Each gig worker enrolls via our enrollment portal and automation does the rest! This allows us to provide support on an individual basis rather a business basis.

For most members, membership has a zero net cost and pays for itself.

We accomplish this with tax savings via the S-Corp election and the tax benefits of The CHAMP Plan.

We do not charge your account or card but simply deduct the fee from your monthly withholding.

$36,000 a year of annual income

Business registered as an S-Corp (We will help you with this!)

Self-employed with no W2 employees

An S-Corp is simply an election declared to the IRS on how you would like to be taxed as a business.

You do NOT need to close your registered business and open a new one, and you need to file form 2553 with the IRS to have your LLC or Corporation taxed with the S election. Our solutions team can assist with this during your enrollment process.